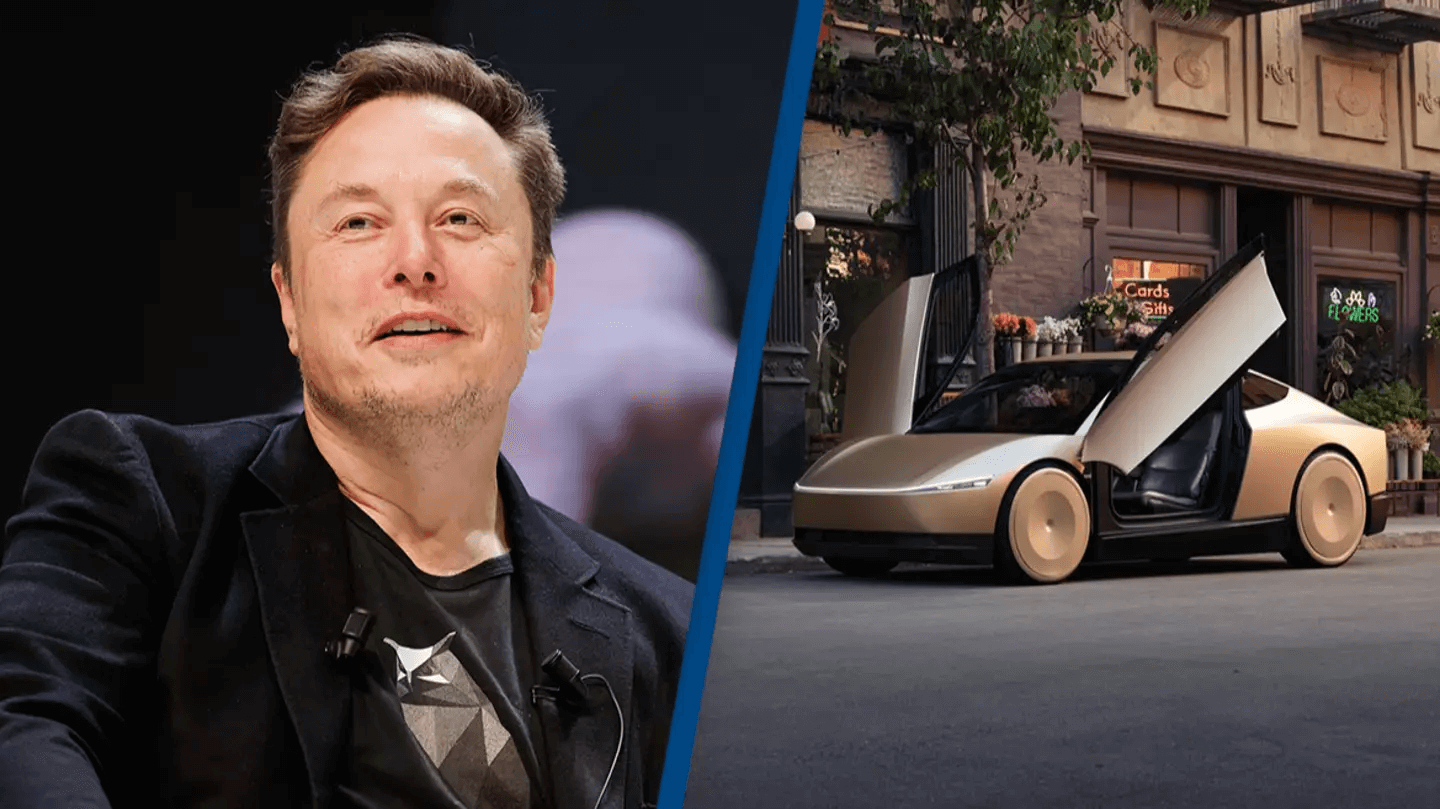

Elon Musk, the face of modern innovation and entrepreneurship, recently witnessed an extraordinary spike in his net worth, adding a staggering $34 billion in just one day. This remarkable increase solidified his position as the richest individual in the world, largely propelled by a record-breaking performance from Tesla. In this article, we will explore the factors contributing to Musk’s wealth surge, Tesla’s latest earnings report, and the implications for the electric vehicle (EV) market and beyond.

Elon Musk’s journey from a tech visionary to the world’s wealthiest person is nothing short of astounding. With his wealth reaching approximately $270.3 billion, his financial success is closely intertwined with the performance of Tesla, the electric vehicle giant he co-founded. Following Tesla’s recent earnings report, the stock surged by 22%, marking its most significant increase since 2013. This article aims to dissect the various aspects that contributed to Musk’s wealth explosion and Tesla’s pivotal role in shaping the future of transportation.

Tesla’s Earnings Report: A Closer Look

Tesla’s latest quarterly earnings report, though mixed, included a critical component that investors had long anticipated: profit. This section delves into the highlights of the earnings report and what they mean for the company and its shareholders.

Key Financial Highlights

| Metric | Q3 2024 Results | Q2 2024 Results | Year-over-Year Change |

|---|---|---|---|

| Revenue | $24 billion | $25 billion | -4% |

| Net Income | $3.1 billion | $2.6 billion | +19% |

| EPS (Earnings Per Share) | $0.90 | $0.75 | +20% |

| Vehicle Deliveries | 470,000 units | 460,000 units | +2% |

Tesla’s net income of $3.1 billion marked a significant rebound, indicating a potential turning point for the company after four consecutive quarters of underwhelming earnings. The mixed revenue performance was overshadowed by the announcement of profit, which buoyed investor sentiment.

Investors’ Reactions

Investors reacted positively to the earnings call, driven by Musk’s optimistic projections for vehicle sales growth of 20% to 30% in the upcoming year. The announcement of the Cybertruck achieving profitability for the first time further galvanized confidence in Tesla’s innovation capabilities.

Musk’s Wealth: The Numbers Behind the Surge

Elon Musk’s wealth surge can be traced back to the stock market’s response to Tesla’s strong quarterly results. The $34 billion increase in his net worth in a single day is not only a testament to the power of Tesla’s stock but also highlights Musk’s significant holdings in various ventures, including SpaceX, X (formerly Twitter), and xAI.

Musk’s fortune growth has widened the gap between him and the second-richest individual, Jeff Bezos, by $61 billion. Tesla’s stock alone accounts for approximately three-quarters of Musk’s wealth, showcasing the deep interconnection between the company’s performance and his financial standing.

Tesla’s Strategic Vision

Musk’s vision for Tesla is ambitious, aiming for the company to dominate the electric vehicle market and expand its influence into other sectors.

Future Vehicle Sales Projections

During the earnings call, Musk projected robust vehicle sales growth, reinforcing investor confidence in Tesla’s future. His optimism is based on several factors, including the increasing global demand for electric vehicles and Tesla’s expanding production capabilities. The projected growth rate of 20% to 30% in vehicle sales is seen as a realistic target given current market trends.

The Road Ahead for Cybertruck

The Cybertruck, Tesla’s highly anticipated vehicle, has finally reached a profitable phase. This milestone is crucial for Tesla as it moves to overcome previous production challenges. Musk’s announcement during the earnings call regarding Cybertruck’s profitability was met with enthusiasm, suggesting that Tesla is on the right track to innovate and address production issues effectively.

The Role of Innovation in Tesla’s Success

Tesla’s success can be largely attributed to its relentless focus on innovation, particularly in the fields of autonomous driving and battery technology.

Autonomous Driving Initiatives

Musk’s vision for Tesla extends into the realm of autonomous driving. He has announced plans to roll out “Cybercab” robotaxis by 2026, with production targets reaching into the millions annually. This initiative positions Tesla at the forefront of the autonomous vehicle revolution, but it is not without its challenges.

Robo-Taxi Plans

Musk’s plans for the robo-taxi service aim to disrupt traditional transportation models. However, regulatory hurdles remain a significant challenge. Despite these obstacles, Musk’s confidence in Tesla’s ability to navigate these challenges underscores his commitment to leading the charge in the autonomous vehicle market.

Challenges Ahead: Production and Regulatory Hurdles

Despite the optimistic outlook, several challenges lie ahead for Tesla. The ongoing delays in the Tesla Roadster’s production timeline raise questions about the company’s ability to meet its ambitious targets. Initially announced in 2017, the Roadster’s production has faced numerous setbacks, leading to skepticism among investors.

Musk’s assurances that the Roadster is “close” to finalization, coupled with hints about a “spectacular” release, create an air of anticipation. However, the timeline remains uncertain, and stakeholders will be closely monitoring developments.

Elon Musk‘s recent wealth surge is emblematic of his influence in the technology and automotive sectors. The impressive earnings report from Tesla has not only solidified Musk’s status as the richest person in the world but has also reinforced the company’s position in the rapidly evolving electric vehicle market. As Tesla continues to push boundaries with its innovative technologies and ambitious plans for the future, investors and industry watchers alike will be keenly observing the company’s trajectory.

The road ahead for Musk and Tesla is filled with both opportunities and challenges. While the future looks promising, the key to sustained growth will lie in successfully navigating production hurdles and regulatory landscapes, all while maintaining the innovative spirit that has brought the company to its current heights.

As we witness this unfolding narrative, one thing is clear: the saga of Elon Musk and Tesla is far from over.

This comprehensive analysis provides insight into Elon Musk’s extraordinary rise in wealth and the pivotal role of Tesla in shaping the future of electric vehicles. With a clear strategic vision and a focus on innovation, Musk is poised to continue influencing the tech landscape in the years to come.

If you want to learn more articles on topics you are interested in, you can visit our website. https://dailyexploreusa.com/

What caused Elon Musk’s net worth to increase by $34 billion in one day?

Elon Musk’s net worth surged following Tesla’s blockbuster earnings report, which revealed the company achieved significant profitability for the first time since mid-2023. The announcement of a 22% increase in Tesla’s stock price—its best performance since 2013—also played a critical role in this wealth increase.

What were the key highlights from Tesla’s latest earnings report?

Tesla reported a net income of $3.1 billion for Q3 2024, marking a significant rebound after four consecutive quarters of disappointing earnings. The company’s revenue was approximately $24 billion, which, although down from the previous quarter, still showcased a solid profit and positive vehicle delivery numbers.

How does Tesla’s stock performance impact Elon Musk’s wealth?

Tesla’s stock accounts for roughly three-quarters of Elon Musk’s wealth. Therefore, fluctuations in Tesla’s stock price directly influence his net worth. Significant gains or losses in the stock market can lead to substantial changes in Musk’s financial standing.

What are Musk’s projections for Tesla’s future vehicle sales?

During the earnings call, Musk projected a vehicle sales growth rate of 20% to 30% for the upcoming year. This optimism is based on the growing demand for electric vehicles and Tesla’s expanding production capabilities.

What is the significance of the Cybertruck’s profitability?

The Cybertruck achieving profitability marks a crucial milestone for Tesla, especially after facing production challenges. This success indicates the company’s ability to innovate and adapt, reinforcing investor confidence in Tesla’s prospects.

What plans does Tesla have for autonomous driving technology?

Tesla plans to roll out “Cybercab” robotaxis as early as 2026, with ambitious production targets in the millions annually. This initiative reflects Musk’s vision of leading the autonomous vehicle revolution, although it faces regulatory challenges.

What challenges does Tesla face moving forward?

Tesla faces several challenges, including ongoing delays in the production of the Tesla Roadster and regulatory hurdles regarding its autonomous driving initiatives. The uncertainty surrounding the Roadster’s release timeline has raised questions among investors about the company’s ability to meet its ambitious targets.

How has Musk’s wealth compared to other billionaires?

After the recent surge in his wealth, Elon Musk’s net worth stands at approximately $270.3 billion, widening the gap between him and the second-richest person, Jeff Bezos, by $61 billion. This ranking reflects Musk’s dominance in the ultrarich category, primarily due to Tesla’s stock performance.

What is Tesla’s overall market strategy?

Tesla’s strategy focuses on maintaining its leadership position in the electric vehicle market while expanding its influence into autonomous driving and renewable energy solutions. The company aims to innovate continuously and overcome production and regulatory challenges to achieve sustainable growth.

Where can I find more information about Elon Musk and Tesla’s developments?

For the latest updates on Elon Musk and Tesla, consider following reputable financial news sources, Tesla’s investor relations page, or industry reports focusing on electric vehicles and technology innovations.